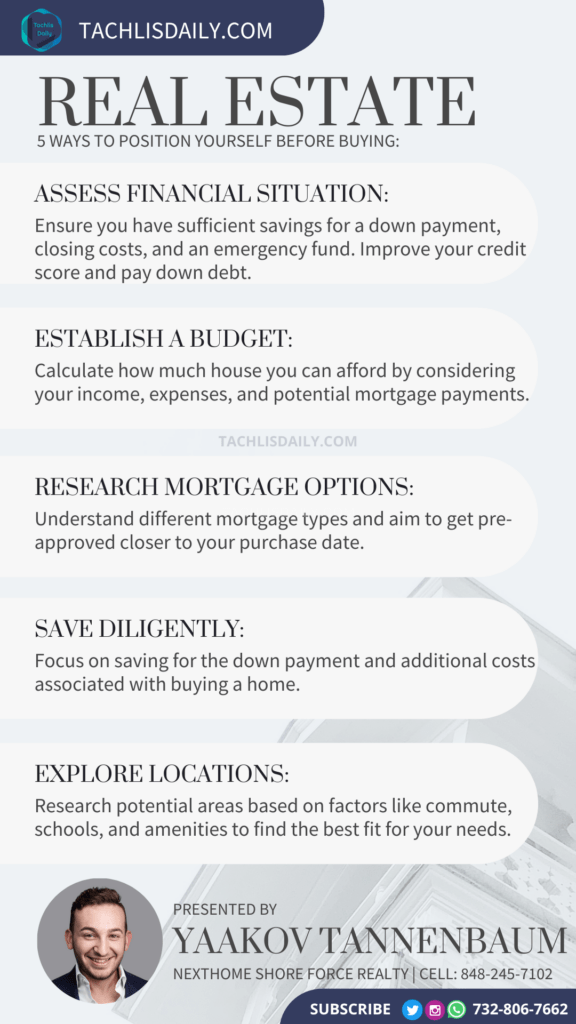

Assess Financial Situation: Ensure you have sufficient savings for a down payment, closing costs, and an emergency fund. Improve your credit score and pay down debt.

Establish a Budget: Calculate how much house you can afford by considering your income, expenses, and potential mortgage payments.

Research Mortgage Options: Understand different mortgage types and aim to get pre-approved closer to your purchase date.

Save Diligently: Focus on saving for the down payment and additional costs associated with buying a home.

Explore Locations: Research potential areas based on factors like commute, schools, and amenities to find the best fit for your needs.