Navigating mortgage interest rates can seem daunting, but with a clear understanding, you can make informed financial decisions when securing a home loan. Let’s break down the key aspects of mortgage interest rates.

What is Mortgage Interest?

At its core, mortgage interest is the annual cost of borrowing money. For instance, if you borrow $100,000 at a 4% interest rate, you’ll be charged $4,000 annually in interest. This amount is then divided annually.

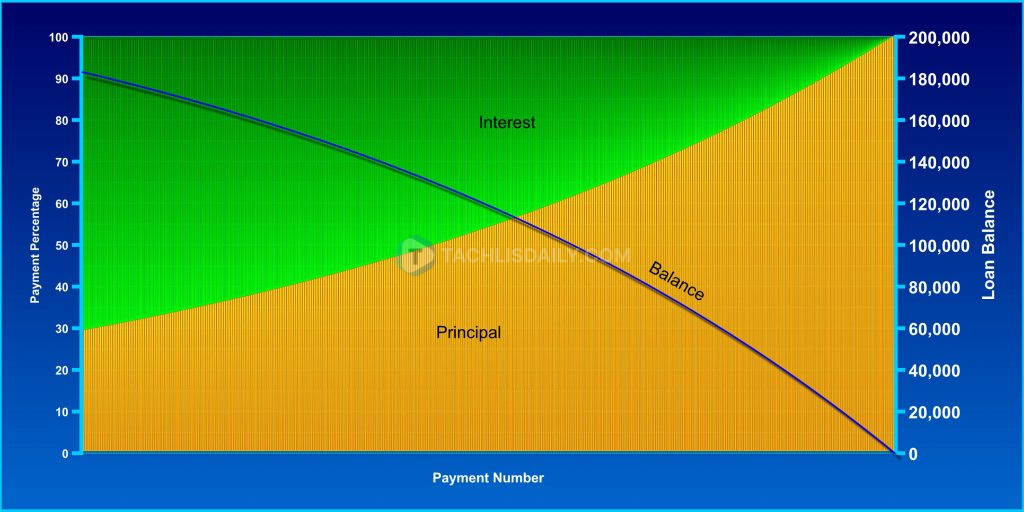

Understanding Amortization in Mortgage Loans

Amortization is an important process in mortgage loans that determines how payments are structured over time. The point is to have equal payment throughout your mortgage cycle, but splitting it up is not the same throughout the loan. Initially, a significant portion of each monthly payment goes towards interest, especially in the loan’s early years when the principal balance is higher. As you make payments, the balance decreases, and therefore, the portion of each payment allocated to interest also decreases. Conversely, more of the payment goes towards reducing the principal balance. Click this link to see an amortization calculator.

Differentiating Interest Rate and APR

It’s important to distinguish between the interest rate and the Annual Percentage Rate (APR). While the interest rate reflects the cost of borrowing money, APR encompasses additional fees like underwriting, administration, and mortgage insurance. Comparing APRs between lenders helps gauge the total cost of the loan beyond just the interest rate.

Fixed vs. Adjustable Rates

Homebuyers often choose between fixed-rate and adjustable-rate mortgages (ARMs). A fixed-rate mortgage maintains a consistent interest rate throughout the loan term, providing stability even if market rates increase. In contrast, ARMs start with a fixed rate for a specified period and then adjust annually based on market conditions, potentially leading to fluctuating payments.

Factors Influencing Interest Rates Several factors influence the interest rate you’re offered:

Risk Profile: Lenders assess your credit score, down payment amount, and loan size to determine your risk as a borrower. Higher risks may result in higher interest rates.

Market Conditions: Economic factors and mortgage-backed securities in the secondary market impact interest rates. Changes in these conditions can lead to fluctuations in mortgage rates over time.

Lender Policies: Each lender sets interest rates based on their operational costs, risk tolerance, and competitive positioning in the market. This diversity allows borrowers to choose rates that align with their financial goals.

Understanding Total Cost

While a lower interest rate may seem appealing, it’s essential to consider the total cost of the loan over its duration. This includes upfront fees and ongoing costs like mortgage insurance. Conducting a total cost analysis, rather than solely focusing on the interest rate, ensures you make a financially sound decision.

Choosing the Right Mortgage

Deciding between a 30-year and a 15-year mortgage illustrates the impact of interest rates over time. For instance, on a $500,000 loan at 6%:

A 30-year term results in $579,191 of interest paid over the loan’s life.

Shortening to a 15-year term reduces total payments to $259,471, saving $319,720 in interest.

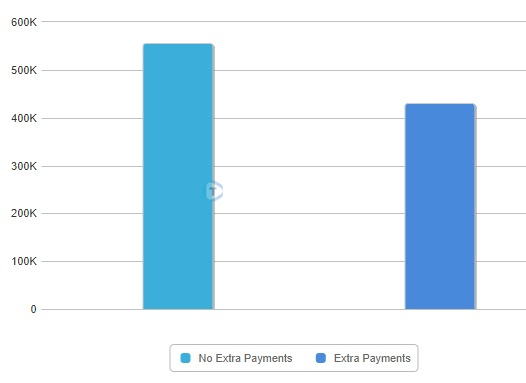

Early Payments and Their Impact

Making early payments on your mortgage can have significant financial benefits. By paying extra towards the principal early in the loan term, borrowers can reduce the overall interest paid over the life of the loan and shorten the repayment period. Even small additional monthly payments applied directly to the principal can accelerate equity build-up and save thousands in interest costs. For example, with a $500,000 mortgage with a 6% interest rate, making one extra payment annually can save $123,031 over your mortgage’s life and shorten the loan’s duration by five years.